- The Emerald Ledger

- Posts

- New York: 57% Open, 100% Growing

New York: 57% Open, 100% Growing

With just 57% of dispensaries live, New York’s market is proving you don’t need full capacity to go full throttle.

With headlines swirling over New York’s newest breakdown—this time involving cannabis shops illegally close to schools, I figured there’s no better cue to dive back into writing than by pulling the Office of Cannabis Management’s licensing dataset for a quick look on the state’s shop rollout progress.

Despite these missteps and others, the state has graduated from launch to growth mode, primarily due to their rollout of license approvals. Just over two years into adult-use sales, the state has crossed $1.9 billion in total sales and is now pulling in nearly $150 million a month, making it the fourth largest cannabis market in the country by monthly revenue — edging out states like Massachusetts despite with a nine year head start.

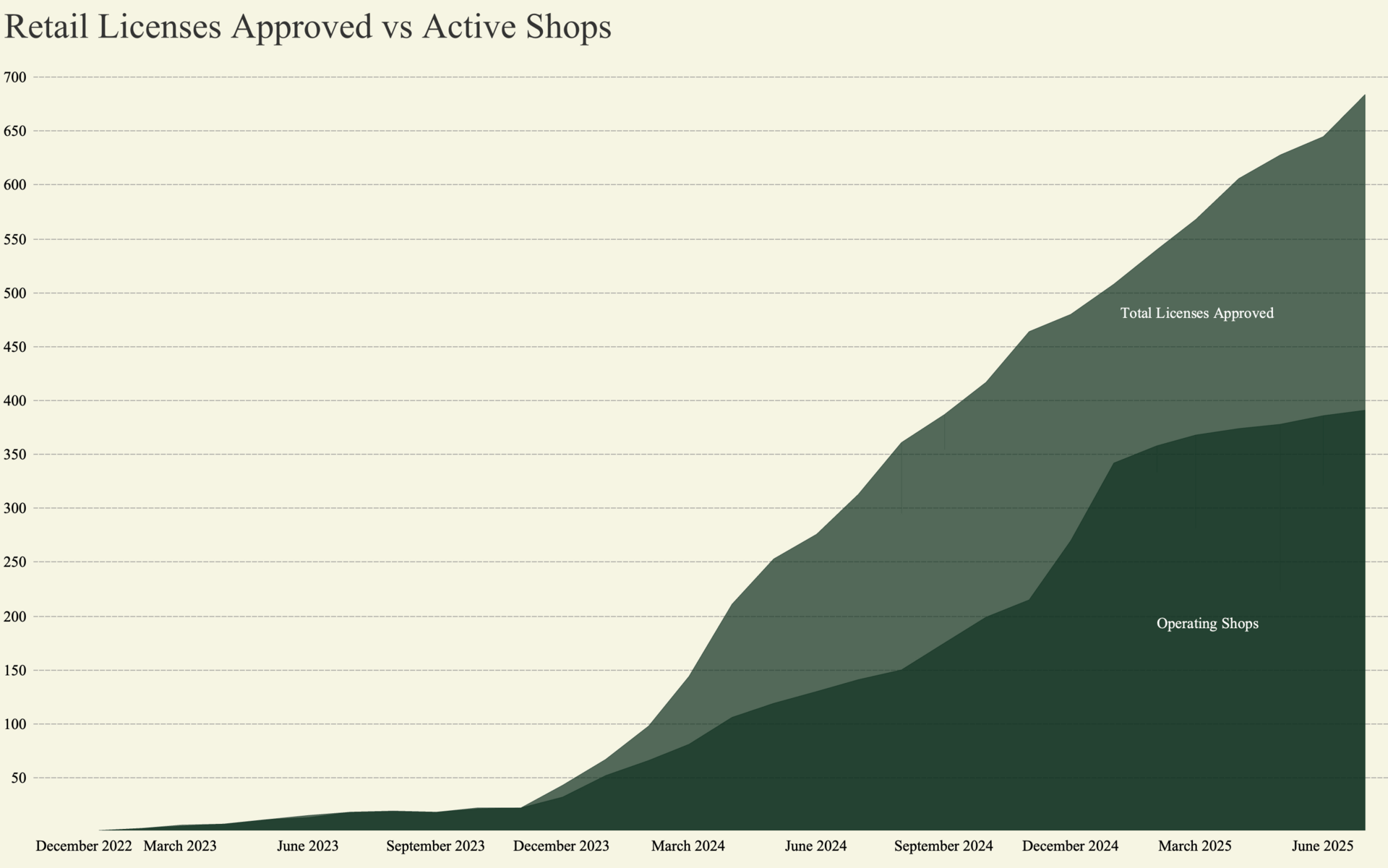

That growth hasn’t come easy. The rollout was infamously slow, starting with just a single store in January 2023, but it’s picked up serious steam. According to the OCM’s license dataset, as of July 2025, 391 shops are operating across the state, up from just 141 one year ago and 18 two years ago. That’s a 2.8x increase YoY and a 22x leap since launch. The number of licenses approved has jumped even faster, from 313 in July 2024 to 684 today.

As it stands 57% of approved retail licenses are operational, revealing the ongoing battle to continue approving applications and allowing storefronts to open. With only over two years worth of data, this number shouldn’t be overly scrutinized, especially given it’s record setting sales pace. In fact, it represents a YoY growth compared to last year’s July standing of 45%.

Source: New York’s Office of Cannabis Management License Tracker

Total sales continue to rise month over month. July’s $148.77M haul represents an 82% increase over the same time last year and nearly double what the state brought in just nine months ago.

Source: New York’s Office of Cannabis Management License Tracker

The revenue-per-store trend is where the market’s shift is most obvious as the market seeks to level out. In early 2023, with only a few stores open and no competition, operators were pulling in north of $1M a month. That figure has gradually declined as more stores opened and competition increased—showing signs of stabilization. Revenue per store hovered around $380K in July, up from its low point of $295K in February and closer to the market average seen in similarly scaled states like Illinois and Massachusetts.

Source: New York’s Office of Cannabis Management 2024 Report, OCM License Tracker & Headset

Category Update

New York’s market is finding its footing. According to Headset, flower remains the top-selling category, generating nearly $51 million in July and accounting for just over 34% of monthly sales. Pre-rolls are growing the fastest among the top categories, now making up 21% of all sales, and up 97% YoY.

Vape pens hold steady at 25% market share, while edibles and concentrates follow at 13% and 3%, respectively. Capsules appear to be the only category struggling, bringing in less than $1M in July and growing only 1.3% YoY

Takeaways

New York’s cannabis market is now pulling in $150M a month, making it the fourth largest in the country by retail sales. That puts it ahead of markets like Massachusetts, despite launching nearly a decade later.

The number of operating dispensaries has jumped to 391, up from 141 last year and just 18 two years ago—a 2.8x YoY increase and 22x growth since launch. After a slow start, rollout has clearly accelerated.

While 684 licenses have been approved, only 57% are operational. Still, that’s up from 45% a year ago, showing gradual progress in turning approvals into open storefronts.

Revenue per store has stabilized around $380K/month, rebounding from a February low of $295K in 2025. It’s far from the $1M highs of early 2023 but now more in line with other mature markets.

Pre-rolls are the fastest growing category, up 97% YoY and now 21% of sales. Flower still leads at $51M in July (34% share), while vapes hold at 25%. Edibles continue growing; capsules remain flat.